Can bp embody the sustainable transformation?

Can bp embody the sustainable transformation?

Introduction

If you ever find yourself scratching your head on companies’ sustainability goals and actions, and saying this looks great, but what does that actually mean? Take comfort in the recognition that many others and I have struggled with similar questions. This post and respective blog is an attempt to wrangle the quickening metamorphosis of companies’ sustainability actions, to not only provide a more enriching education for myself, but also a middle ground of outlines for fellow aspiring impactors. First, I’ll start with walking through bp’s recent 2020 sustainability report, attempting to pick out key details while still thoroughly covering the work presented. Second, I’ll take a step back and look at the bigger picture, how does bp fit into the oil/gas sustainability industry. Third, I’ll take one final step back to look at the biggest picture, bp fitting into daily life, global actions, and the future that is (no pun intended) being driven forward. Finally, I’ll end with a historical fact that encapsulates some weird quirk of humanity and something great and not so great about current day bp. Let’s go!! (The first part will be a breakdown of bp’s sustainability report with following publications on the second and third parts possibly being significantly delayed due to external situations/commitments)

BP’s 2020 Sustainability Report

The report is broken into 11 main sections, for anyone curious to break into it for a full read. The first three sections introduce bp and their respective background. The fourth and fifth sections outline the foundations of bp and overarching goals of sustainability. Sections six, seven, and eight dig into the 20 aims of bp’s sustainability impacts. Section nine and ten describe bp’s collaboration externally. Appreciatively, the final section 11 details the reporting methodology utilized (something which all companies should do). Time to start with section 1!

Section 1: Introduction

All great corporate reports start with a candid picture of the flag bearer and respective dialogue on the intended focus, this is none the exception. Bernard Looney posits that profit and positive change can walk handsomely together. Regardless, the pandemic is quickly identified as shaping the world and bp’s recent year in action, and most excitingly, Bernard highlights the shift from an International Oil Company to an Integrated Energy Company. This integrated company now pivots to encapsulate offshore wind, solar development, hydrogen infrastructure, biofuels, and carbon capture tech, all very exciting and critical developments to acknowledge. Three core tenets are brought up: getting to net zero, improving people’s lives, and caring for our planet. Initially in 2019 there were 10 aims in bp’s sustainability goals (which in their case meant getting to net zero). Now 10 more aims join the stars with 5 directed towards people and the other 5 for the planet. Symbolically, only two people introduce the reader to a 63,000-person company (see image below): Chief Executive Officer Bernard Looney (employee from the very beginning working his way all the way up) and EVP, strategy & sustainability Giulia Chierchia (a recent enlistment from McKinsey).

Chief Executive Officer at bp, Bernard Looney, and Executive of Vice President, strategy and sustainability, Giulia Chierchia.

Chief Executive Officer at bp, Bernard Looney, and Executive of Vice President, strategy and sustainability, Giulia Chierchia.

Section 2: Sustainability at bp

Bp has a self-created framework guiding their actions forward, with three main buckets broken down by low carbon energy (ex: Equinor US offshore wind deal, light source bp growth, and renewable hydrogen partnership w/ Orsted), convenience and mobility (EV charging adoption, EV partnerships/site deployment), and resilient and focused hydrocarbons (new investments/pipeline deals). These focus areas then lead to three sources of differentiation (convenient that both sections have three buckets): Integrated energy systems (optimize energy usage), external collaboration (currently three partnerships: Aberdeen, Microsoft, and Houston), and digital and innovation advancement (close to 40 new ventures funded).

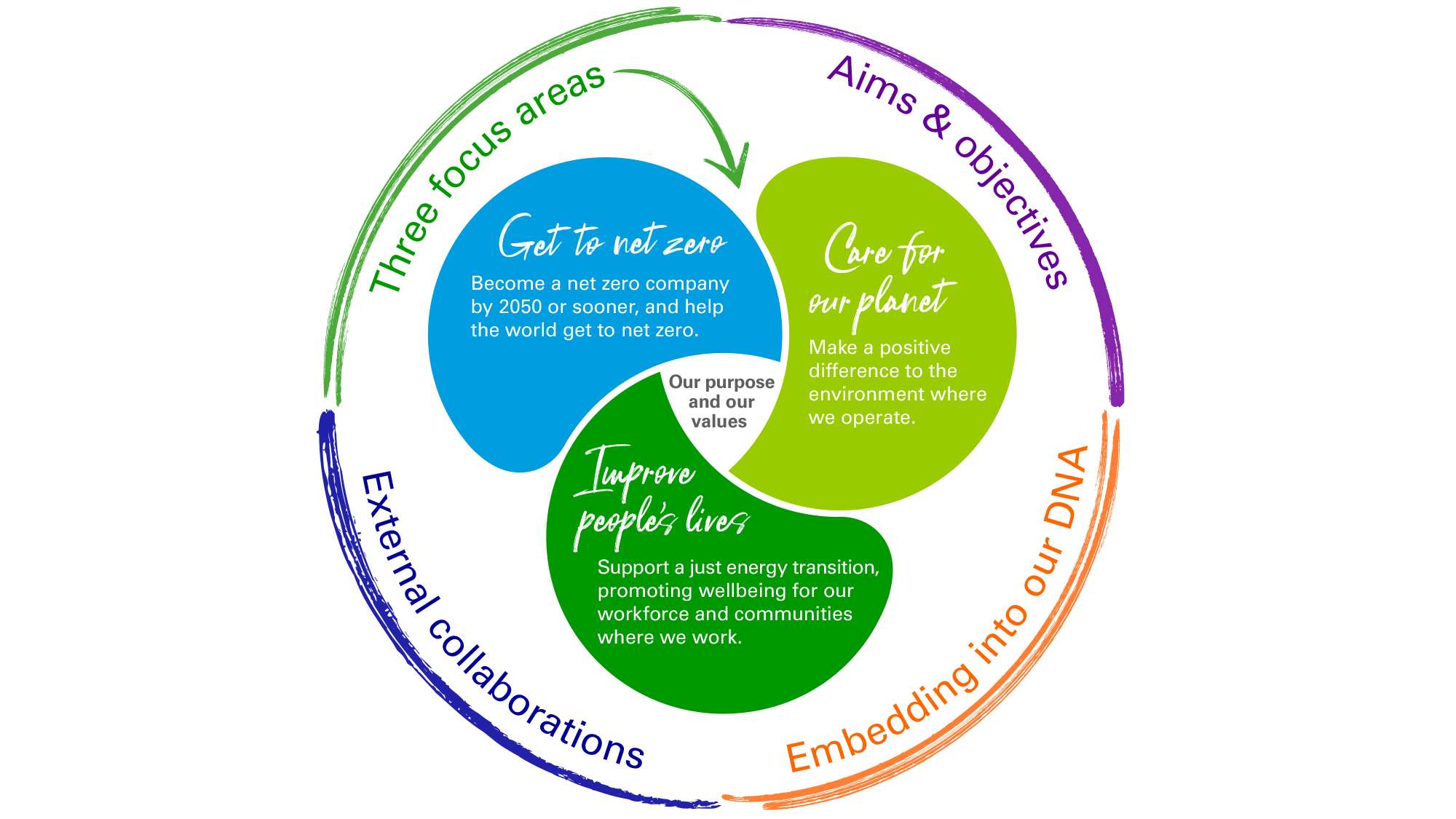

They then have a circular sustainability framework which I like detailing engaging stakeholders and embedding practices into the DNA and a breakdown of the 10 net zero goals, 5 people, and 5 planet goals. I am quite curious as to how bp came up with these numbers of 10, 5, and 5. Could it be because the sum is 20 and the report was released in 2020, with the long-term goal moving forward to add a new sustainable goal each year to the planet or people side… the door is wide open on future expansion.

The circular sustainability framework at bp.

The circular sustainability framework at bp.

Section 3: 2020 at a glance

Bp then jumps into looking at how 2020 turned out. In a short overview: it was extremely hard for bp and the oil and gas industry in general. The detailed answer is grim. $20.3 billion dollar loss in 2020 (from a $4.0 billion profit in 2019). 7,000 employees laid off, it does not take long for one to realize that COVID-19 produced a seismic shock across the oil and gas field. However, there are some positives mentioned above in section 3 in investments outside of core profit drivers and elaborated on in response to the struggles of COVID. The growing investment in renewables, increase in electric vehicle charge points, and continued growth in Lightsource bp all rise to the top. Collaborations were also announced with Houston, Abeerden, and Microsoft pointing as well to a growing potential to look externally as well as internally. Partnerships around the world from the UK to Alaska and governments in Angola to Mauritania were on the receiving end of temporary no charge fuel, humanitarian assistance, or COVID relief. Put bluntly by Bernard Looney: “Our industry [oil/gas] has been hit by supply and demand shocks on a scale never seen before, but that is no excuse to turn inward.”, let us then see what the outward perspective looks like.

Overview of bp's 2020 statistics compared to 2019 in the biggest restructuring time period of their 112 year history.

Overview of bp's 2020 statistics compared to 2019 in the biggest restructuring time period of their 112 year history.

Section 4: Our Foundations

Section 4 details bp’s operating procedures and relevant statistics. Benchmarked against the industry, bp consistently outperforms in worker safety and operating procedures. The granted practices of reducing bribery, publishing revenues and donations to governments, and weeding out discrimination glare out against an industry backdrop that has often been murky at best. The section then moves on to detailing the bp Foundation which works with employees in charity donations and providing money for humanitarian relief efforts. In total: $6.4 million dollars were donated by employees (an average of $100 per employee), evenly spread across regions with a matching $6.1 million from the company and a concurrent $2.1 million donated to communities. In summary, bp reportedly contributed $188.8 billion dollars in economic activity in 2020, almost a fifth of a trillion dollars, a mind-boggling amount (however a steep decline from the $288.8 billion in 2019) with my question being how is this calculated?

Section 5: Aims and objectives

Section 5 finally provides the appetizer of what bp’s sustainability direction looks like. Aims 1-10 tackle getting to net zero, 11-15 target improving people’s lives, and 16-20 caring for the planet. Let’s take a precursory purview of the aims. Aims 1-4 detail technological advancements (reducing scope 1 and 2 emissions to zero by 2050-a time far off yet required, reducing carbon intensity, and tracking methane) with aim 5 exploring other financial and energy investments into non-oil and gas businesses, however I would like to see grounded %s or raw amounts vs simply increasing proportion. Aims 6-8 deal with soft skills (increasing advocation, incentivizing employees, and reorienting expectations). Aim 9 I personally do not like as it depends on external validation with no clear structure for becoming an industry leader in transparency and reporting. Aim 10 adds a new internal team targeting integrated clean energy and mobility solutions, however it will be fascinating to explore the authority/opportunities this group holds.

Aims 11, 13, and 14 target specific amounts of money donated to social welfare programs ($1 billion in supplier diversity spend and build 1 million sustainable livelihoods) or people to provide clean energy to (36 million by 2030-lets see how this number was agreed upon). Aims 12 and 15 are more aspirational pushing to support a just energy transition (a multifaceted oftentimes overlooked issue which needs to be broken up) and enhancing the health and wellbeing of employees, contractors, and communities (hard to measure and even harder to implement). Aims 16, and 18-20 advance broad environmental topics such as enhancing biodiversity, enabling nature-based solutions, incorporating circulatory, and developing a more sustainable supply chain. While in my opinion aim 17 provides the strongest environmental goal of becoming an actionable and testable insight of becoming water positive by 2035-let us see why this was chosen. The section then ends detailing how each aim connects to the UN’s SDG goals. From an initial expectation, goals are still very cloudy and waiting to be concretely developed, however potential is evident, and conviction will hopefully follow!

Bp's new investments come on the winds of fresh advertising, supposedly echoing the shift from a International Oil Company to an Integrated Energy Company.

Bp's new investments come on the winds of fresh advertising, supposedly echoing the shift from a International Oil Company to an Integrated Energy Company.

Section 6: Getting to net zero

Section 6 is all about getting to net zero emissions both internally (with 5 aims) and externally (with another 5 aims). Bp immediately starts off stating that in their goals they attempt to balance maximizing ambition, keeping hydrocarbons a critical component, and staying financially resilient, a tough 3d wire to walk. Bp also aims to reduce overall hydrocarbon business (40% lower in terms of production by 2030 compared to 2020). The mention of sustainable emissions reductions (SERs) is also brought up as a lever to move forward (from my understanding improving operational efficiencies-electrification/RE energy and preventing emissions that would have happened). Bp also does acknowledge that “the absolute level of emissions associated with our marketed products will grow up to 2030” due to penetration in fast growing markets. The focus on scope 1 and 2 emissions also points to the internal focus of bp’s plan, with the thought being that scope 3 will take care of itself if the first two are done correctly-possibly? Interestingly, bp will not rely on carbon offsets (unless in employee programs), however they do offer offsets for other companies.

Ten aims developed by bp tackling emissions both internally and externally and respective relevant UN Sustainable Development Goals (SDGs)

Ten aims developed by bp tackling emissions both internally and externally and respective relevant UN Sustainable Development Goals (SDGs)

The first driving aim of bp is to transform into net zero operations by 2050 through operational efficiency methods, reducing flaring and managing methane. Unfortunately, divestments are counted as reductions in emissions (such as in their recent selloff on the north slope in Alaska), however the environmental impact may only get worse once large companies leave the field (relation to my recent research at SFI and see interview with CEO that discusses Q). Scope 1 represent the lion’s share of emissions with more than 80% across years coming from running asset emissions. Aim 2 dives into the scope 3 emissions upstream. Methane reduction (a far more potent yet critical operation of extraction) is targeted in aim 4 through technological innovation and situational awareness. Growth in alternative energy investments is being spearheaded by the regions, cities and solutions integrator (RC&S), and should serve as a catalyst for future development. Bp also is diversifying into solar and wind development, bioenergy (sugarcane production in Brazil which allows decarbonization credits), Carbon Capture Use and Storage (CCUS), and both blue and green hydrogen production. Bp also is exploring the digital financial side, acquiring a controlling interest in Finite Carbon, the leading provider of forest carbon credits in the US. Over the Atlantic, in the UK, bp is a member advancing the Net Zero Teesside (NZT) and Northern Endurance Partnership (NEP) projects which aim to decarbonize nearly 50% of the UK’s industrial cluster emissions through CCUS techniques-an awesome challenge to tackle.

Bp's Lingen refinery in northwestern Germany, which plans to utilize wind energy to produce green hydrogen with reduced water intensity.

Bp's Lingen refinery in northwestern Germany, which plans to utilize wind energy to produce green hydrogen with reduced water intensity.

The other five aims focus on increasing corporate responsibility in advertising, incentives, transparency, and partnerships. The incentivization of employees is quite novel, with a peer-to-peer employee recognition platform being launched for sustainability actions. They also hold an employee carbon offsetting scheme which covers travel and home energy emissions for employees who choose to participate which is partially funded by bp, and now running in the UK, US and Germany. Noteworthy: bp publicly states they work with four cities and corporations (Houston, Aberdeen, Microsoft, and Qantas), with plans to eventually partner with 10-15 cities by 2030 and corporates in three industrial sectors (high tech and consumer products, heavy transport and heavy industries-not easy to decarbonize sectors). Other organizations collaborating with to increase sustainability include: Amazon (data center renewable power) and Uber and Didi (two EV partnerships to increase connectivity and adoption). It is clear that bp would like to position themselves as leaders in the EV charging space as well, with goals to grow to a network of charging points sevenfold (from 10,000 to 70,000) by 2030. This charge into the mobility space (aviation, cars), points to following questions of heavy duty charging from industries such as maritime and mining, which hopefully will be targeted in the new partnership development cycle. Overall, initiatives do look very exciting, with an expected exponential growth of interest in the space, it will be fascinating to see how bp adapts their plans.

Youtube video detailing how bp plans to tackle scope 1,2, and indirectly 3 emissions through operational and technological advancements.

Section 7: Improving people’s lives

Aims 11-15 dig into the people side of life, something which can be easily overlooked on such a materially focused industry. Aim 11 focuses to provide clean energy to benefit more than 36 million people (a number calculated from their expected renewable generating capacity-50 GW and average electricity consumption per capita value from 2019-an odd fact as we can expect per capita values to increase over time and most certainly not be even over the globe). Unfortunately, aim 11 of providing clean energy to benefit more than 36 million people looks like a thin veil over the intended financial development of renewable projects, with no information on improving accessibility (however they do expect a roadmap by the end of 2022-3 years too late in the goal of benchmarking from 2020->2030). Welcome announcements on targeting a just transition is illuminated, however much still seems to be fluid, with metrics yet to be finalized and civic dialogue, transparency, and local outreach aims not yet agreed upon. The intended focus is still slightly myopic, as from their report “our focus will be on our employees, wider workforce and local people in places where we are developing renewable energy projects”, while in reality the environments which need the just transition are not included in stakeholder interactions/local surroundings. Foundations of an equitable society are included, such as protecting labor, security and human, and people and communities’ rights. Due to bp’s international reach (including countries such as Oman, Mauritania and Senegal, and Malaysia) critical topics such as no forced labor, receiving salaries on time, and full worker’s rights can fall on the by sides due to cultural differences and low accountability. Underscoring the regularity of human right violations and community issues in bp’s operations, 6 pages are devoted to the aim, significantly more than past aims.

Five aims targeting the people aspect and just transition framework.

Five aims targeting the people aspect and just transition framework.

Aim 13 represents sustainable livelihoods, with exciting environmental and local community projects such as the sweet gold program which worked alongside 530 beneficiaries to plant over 100,000 nectar trees in Azerbaijan and enabling the Oman government’s educational digital platform to reach 600,000+ students and 55,000+ teachers in the next five years. Diversity, Equity, and Inclusion (DE&I) are spotlighted in an industry that has historically been dominated by white males. In upper-level leadership (which magnify the biases hidden in organizations), nearly 40% of the 120 newly appointed extended leadership team members are women. With heightened focus on increasing proportions of minorities, a fascinating discussion on how to interact with white males is left out (check out this recent WSJ article on the topic). A critical subject exacerbated by COVID and signaled out in aim 15, looks to increase mental health awareness and tools, however not reported are employer surveys which are essential to gauging the effectiveness of such programs. The details of mental health are often convoluted and tricky to nail down, however a greater corporate awareness is essential, but leadership should be weary of becoming disconnected from the true situations that plague employees (the growing mental health debate). Ultimately, the people section is constructive yet in need of solidified benchmarks and greater situational awareness.

Section 8: Caring for the planet

It may be one of the most blatant understatements that all companies rely on the planet for their survival (either directly or indirectly), with many seeing environmental goals as an unnecessary burden on their operations-the irony commences…Bp broaches the subject with the involvement of the Net Positive Impact (NPI) metric. Accordingly, the NPI is “when the negative impacts on biodiversity caused by a project are outweighed by measurable outcomes from actions taken in accordance with the mitigation hierarchy to achieve socially sustainable biodiversity gain”. So how exactly do you calculate this NPI? I’m not sure…. I couldn’t find an exact calculation of it, however operational mitigation measures in one case included applying Joint Nature Conservation Committee (JNCC) guidelines and use of MMO (Marine Mammal Observer) and Passive Acoustic Monitoring during nighttime operations or periods of low visibility. The answer for the NPI calculation might be in bp’s recent stance on their biodiversity position, collaborating with one of the oldest environmental organizations, the Fauna & Flora International org, to support analysis and discussions on critical areas and develop their NPI methodology. Regardless, it would be fascinating to understand how bp weights conflicting environmental and financial results, and the full life cycle of an operation.

Final five aims highlighting the macro topic of biodiversity and environmental issues.

Final five aims highlighting the macro topic of biodiversity and environmental issues.

Aim 17 of becoming water positive provides a supposedly clear target to meet or fail. This is due to the outlined goals of becoming 20% towards water positive by 2025 and 100% by 2035. Two paths will lead to achieving this goal. First is in operational efficiency and effluent management, with a clear focus on improving major operating sites which represent 98% of total freshwater withdrawals. The second path involves external collaboration to pilot water replenishment projects in stressed and scare catchments close to operations (covering 8% of freshwater consumption in regions of high or extremely high-water stress). A careful tightrope has to be walked, akin to the carbon offset discussion, such that bp does not adopt a water offset scenario. Once again it would be fascinating to see how bp interacts with local communities and higher-level organizations on water life cycle analysis in their operations. Aim 18 then introduces the interesting concept of nature-based solutions (NbS). As presented, NbS are actions to protect, sustainably manage and restore natural or modified ecosystems (Exs: coastal erosion control, soil erosion control, green roofs, soft green engineering or wastewater treatment). Another two angles will be taken in utilizing NbS.

Areas of interest in Nature-based Solutions (NbS). With bp yet to identify key areas of development in NbS, future strategies can vary widely.

Areas of interest in Nature-based Solutions (NbS). With bp yet to identify key areas of development in NbS, future strategies can vary widely.

The first route is the exploration phase, akin to searching for oil/gas wells albeit in a much less defined manner. In this process bp plans to work with partners, including FFI, to tackle local problems through a biodiversity lens. Due to the nature of this process, everything appears quite hazy, however bp states the presentation of NbS will be used by the end of 2022. The second option is on the implementation side of proffering carbon offsets that protect or restore nature. Conflictingly, bp hints at the future where they “intend to reach our [bp’s] 2030 emissions reduction aims without relying on offsets – but they may help us to go beyond those aims if we can.”, an open door for future finagling. A spot to keep your eye on is the recent majority ownership bp took in Finite Carbon, perhaps once again hinting at the introduction of offsets in bp’s sustainability goals in the future.

Aim 19 makes me excited as it is all about circularity! Positive steps include bp’s stance to move all bp-owned food brand packaging in Europe to be reusable, recyclable or bio-degradable by 2025 (another sign that external pressure mainly in their home continent is nudging them forward). Delays are occurring though such as waste stream granularity only expected to be achieved by the end of 2022 and future circularity aims announced by 2023 (see the Ellen MacArthur foundation’s circularity gap report on what companies should be aiming for). It would also be fascinating for bp to take a reevaluation of looking at ownership in their products as well instead of the usual disposal to be recyclable and compostable in future operations. In the final aim 20, a sustainable supply chain is rightly labeled as not only encompassing environmental details, but also social issues which are often swept under the rug. Innovation in exploring greater environmentally friendly options (switching between transit modes in operations) and renewable PPAs are also becoming much more frequent across industries and in bp. In general, section 8 is expansive in targets, which leaves tremendous potential to push the boundary forward in bp and the oil/gas industry, however also significant room for failure.

Reporting on how social issues may fall behind in sustainable supply chains due to the heightened focus on environmental factors (Source: MIT State of Supply Chain Study)

Reporting on how social issues may fall behind in sustainable supply chains due to the heightened focus on environmental factors (Source: MIT State of Supply Chain Study)

Section 9: Embedding sustainability

Section 9 is all about the internal functioning of bp and the respective reshuffling occurring. Areas of development include corporate level reconfiguring, updating of bp’s Operating Management System (OMS) to take into account sustainability performance-something which most likely should have been there much earlier. Bp also mentions their new sustainability data management system, OneCSR, which provides data on carbon, environmental, and social impacts and performances, however there is no clear transparency in how the system operates. The inclusion of GHG emissions in operations is becoming more evident, with certain caps being put in place on their investment decisions. Bp’s OMS is continually brought up as the hub to base decisions off of, which covers a wide range of topics such as health, safety, security, the environment, social responsibility and operational reliability. The mention of the recent largest restructuring in bp’s 112-year history, points to a critical turning point in the operations and direction of bp, with the intended focus of becoming more lean and embedding sustainability into their actions. In this restructuring the supposed reinvention of the leadership occurred, – halving senior leaders from 240 to under 120. However interestingly, bp then also appointed 740 new leaders below senior level – who from bp’s words: “have a track record of delivery, are curious and open-minded, purpose-driven, lead through our values (especially safety) and are empathetic.” Perhaps bp has reduced the top heavy aspect of leadership, but inadvertently moved the weight slightly lower in the chain, would love to look at the bigger picture with numbers in leadership roles. This insight echoes what the bp pulse employee survey found where one of the top recommendations was to be more transparent about the new organization structure after COVID.

Simplified overview of bp's Operating Management System (OMS) across lifetimes and the inclusion of environmental principles

Simplified overview of bp's Operating Management System (OMS) across lifetimes and the inclusion of environmental principles

Section 10: External collaborations

Section 10 highlights the various partnerships bp has due to its international reach and considerable heft in the oil/gas industry. Bp is enrolled in more than 12 getting to net zero groups, providing financial and technical support in white papers and goal setting moments. Only one external organization is mentioned in improving people’s lives, a group called Mind, targeting mental health topics across England and Wales, a sign of potential future development in this area. Bp is then on the slightly lower side as well with two organizations joined focusing on caring for the planet. From raw numbers it is clear that greater support/outreach can be occurring in the other two categories outside the getting to net zero ambition, a critical component of forming a just transition. On the media side, it is quite welcome to get Q&As with the CEO, an entire week titled bp week discussing the transition to a green company, and outreach in the ESG investment community. Four main stakeholders are explicated, customers, society, government, and supply chain partners. A noteworthy mention is from the society section on the biogas development program in China, which saw the replacement of fuels such as wood and coal with biogas, eventually generating more than 10,000 jobs, reducing health impacts, and since it began in May 2012, preventing more than four million tones of CO2 emissions from being produced. This situation in hindsight looks very environmentally encouraging but, on the flipside, represents a plain financial opportunity to grow in the Chinese market. Customers, governments, and supply chain partners are all seen as critical components in outreach campaigns and will continue to do so, with a future electric environment representing an intriguing democratization of a once balkanized energy structure.

Some of the areas mentioned by bp for increasing innovation and partnership involvement (from top left clockwise: Aviation decarbonization, water management awareness, green hydrogen, EV access points, bio-energy, and maritime decarbonization, )

Some of the areas mentioned by bp for increasing innovation and partnership involvement (from top left clockwise: Aviation decarbonization, water management awareness, green hydrogen, EV access points, bio-energy, and maritime decarbonization, )

Section 11: Reporting details & Summary

Section 11 is a welcome appendage to a growing agglomeration of sustainability proclamations, with this section revealing how sustainability is reported at bp. A six-step cycle is enunciated in how bp decides on its sustainability process: progressing from the ideation, to the rumination, and eventual implementation of goals outlined (see page 92 if interested in more details). The actual generation of sustainability insights falls to Deloitte in their operations, with a public ESG datasheet being provided, a critical step in the open transparency movement. Overall, bp’s aim to shift towards the greening company landscape is quite exciting. With an expected 40% decrease in production by 2030, and a significant financial ramp up in non-carbon intensive industries, there is no doubt that bp has eyes on a larger prize to survive. The question which hearkens back to the early 2000s, is will the transformation from an international oil company to an integrated energy company envisage missives of the beyond petroleum snafu?

CEO: Bernard Looney presenting at bp's one week media presentation, showcasing their recent sustainability initiatives. There is no doubt that oil and gas will play a future role in the world, however can bp straddle the line between environmentally friendly and profit driven?

CEO: Bernard Looney presenting at bp's one week media presentation, showcasing their recent sustainability initiatives. There is no doubt that oil and gas will play a future role in the world, however can bp straddle the line between environmentally friendly and profit driven?